The best time to buy is usually a year before you actually purchase something. The reason is that the greatest strategy to build real wealth in real estate is to buy and hold for a long period of time. It is almost a sure bet and below is a chart that I think really illustrates my point.

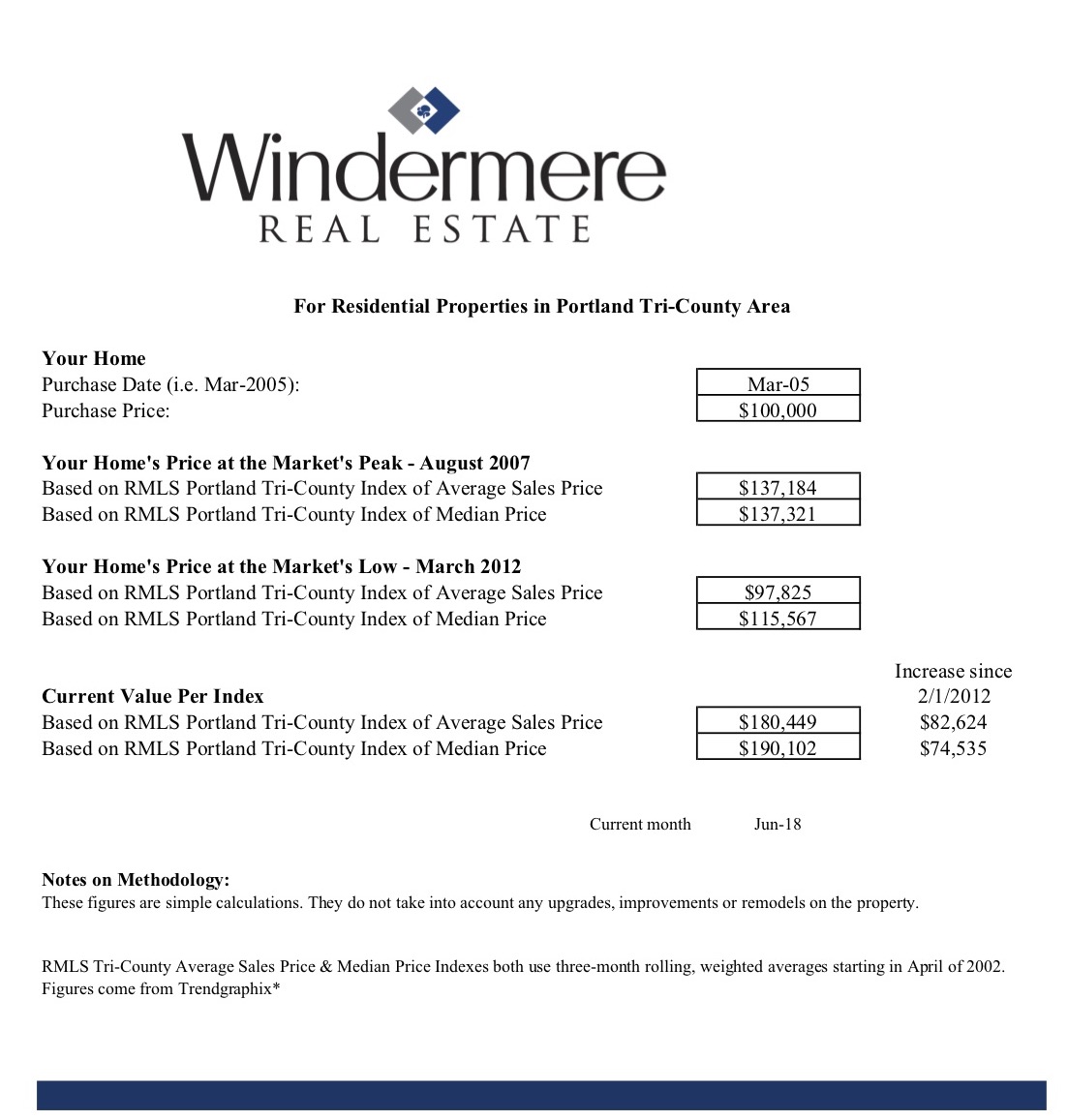

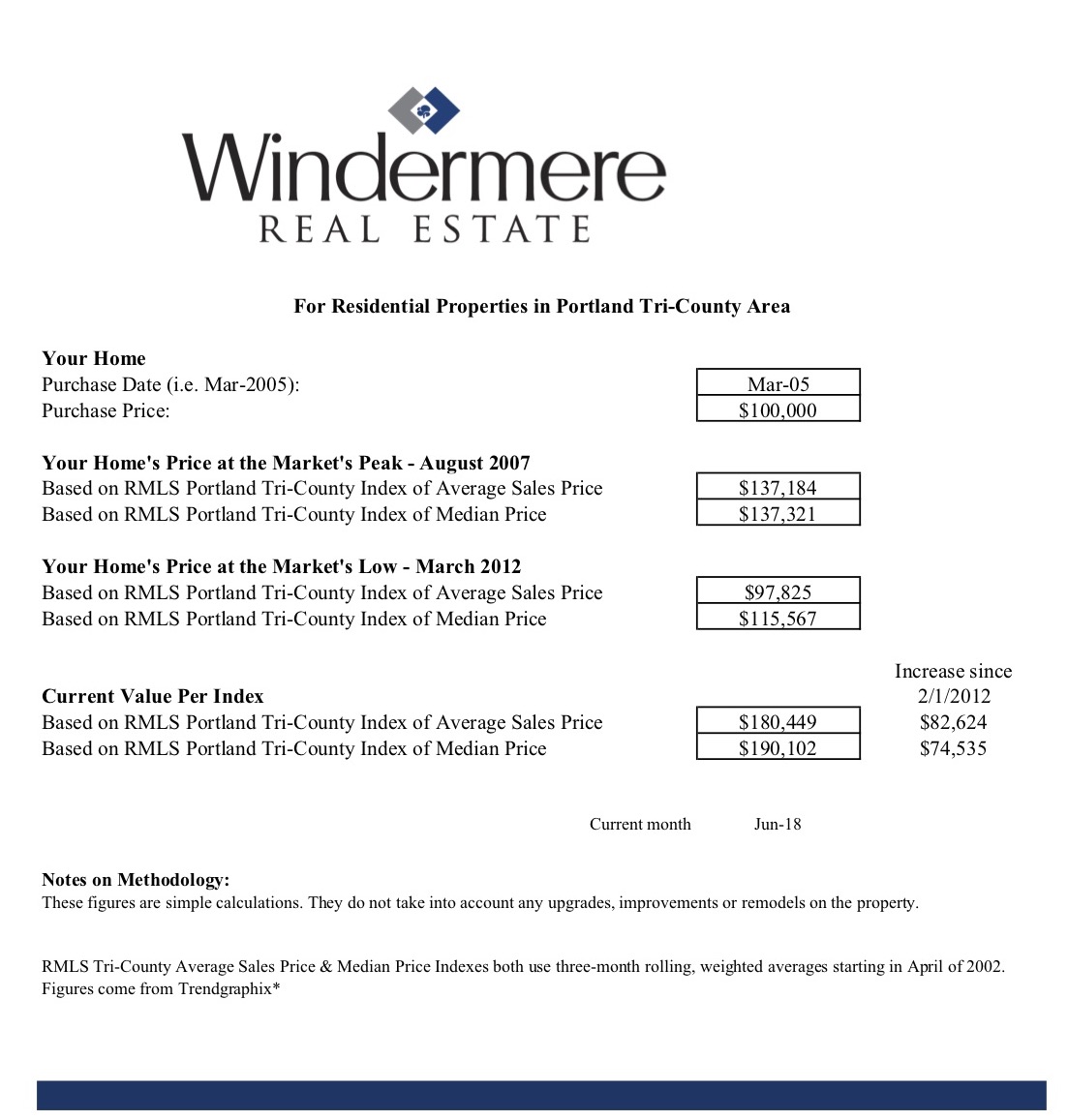

Let’s say a person purchased a hypothetical property in 2005 for $100,000, cash. This was the beginning of the run-up to the market peak and based on data from RMLS for the Tri-County area, by August 2007 that property would have seen a peak value of $137,184 and that buyer was feeling groovy.

Then we saw a total market crash and that same property’s value fell to $97,825 by March 2012. So that buyer is now super bummed, stressed, and feeling far from groovy. In their mind, they have now lost $39,359 in equity. But chin up! They actually only lost $2,175 in equity (purchase price minus current market value). And in terms of actual cash, they have not lost anything since they have not sold the home.

Today, this same house is now worth $180,449. This is 80% above the original purchase price, or about 4.6% annual appreciation. They feel groovy again! Even the folks that purchased at the peak of the bubble in 2007 are feeling groovy!

Current market fundamentals are strong. 30,000-40,000 people are moving to the metro area every year and we are still behind delivering new units since we had essentially zero new inventory during the lean years. On top of that prices are still increasing faster than historical averages and inventory is tight. So my answer to “when is the best time to buy?” Its when a person has their finances in order and are ready to call Carmel and me. Good ol’ fashioned time is the greatest hedge against market instability.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link